Top 5 considerations for GASB 101 readiness

In June 2022, the Governmental Accounting Standards Board (GASB) issued GASB Statement No. 101, Compensated Absences, effective for fiscal years beginning after Dec. 15, 2023. GASB Statement No. 101 supersedes GASB Statement No. 16 and provides a unified model for various types of compensated absences, including certain types of compensated absences that weren’t previously considered under the old standard.

In June 2022, the Governmental Accounting Standards Board (GASB) issued GASB Statement No. 101, Compensated Absences, effective for fiscal years beginning after Dec. 15, 2023. GASB Statement No. 101 supersedes GASB Statement No. 16 and provides a unified model for various types of compensated absences, including certain types of compensated absences that weren’t previously considered under the old standard.In addition to considering the impact of this standard on the year-end accruals in the year of implementation, organizations will need to consider the impact of this new pronouncement on the beginning balances presented in the financial statements given the transition provisions. This may accelerate the need to begin efforts sooner rather than later in order to gather appropriate data.

For example, organizations with Dec. 31, 2024 year-ends that present single-year statements will have to restate beginning net position, as of Jan. 1, 2024, for the cumulative effect of this change. For entities with comparative statements, the adoption of this standard must be implemented retroactively by restating financial statements for all prior periods presented, if practicable.

Here are the top five areas of focus that are critical to keep in mind when implementing this standard.

1. The right starting point

The first step is to gain a complete understanding of your organization’s compensated absence policies, including understanding how policies may be different for certain employee groups and considering any policies that are in place but perhaps not formally documented.

Consider whether different employee groups have particular policies, including union versus nonunion, or full-time versus part-time, and whether there are nontraditional compensated absences offered such as personal observance time, union release time, and personal time. We’ve found that some governments may have complex compensated absence policies that have significant nuances that need to be better understood to successfully apply the concepts in this standard. It’s important to start gathering this information now.

2. Data needs and analysis

Organizations can get ahead of GASB 101 by taking a data-driven approach to adoption. The application of the “more likely than not” threshold requires an assessment of relevant factors, including historical usage or retirement rates, that might be derived from the organization’s existing data but may not be information that’s readily available, requiring a bit of pre-planning. GASB 101 doesn’t define the number of years or types of historical data that need to be considered to formulate assumptions, nor does it define how data should be disaggregated; organizations will need to consider how much information is required and at what level in order to ensure the accuracy of these estimates.

Some of the data needed to make these estimates and judgments may require assistance from your organization’s IT staff or third-party vendors. Proactively identifying data needs and determining how this data could be captured with the organization’s existing IT system can save significant time in the implementation year. Further, any gaps in data needs that are discovered now can be identified and addressed prior to the required adoption date to help ensure a smooth transition.

Proactively identifying data needs and determining how this data could be captured with the organization’s existing IT system can save significant time.

3. Approach to “more likely than not” principle

For compensated absences that fall under the definition in GASB Statement No. 101, organizations will need to consider both liabilities for leave that has not been used and liabilities for leave that has been used but not yet paid or settled. There are three criteria for liability recognition related to leave that hasn’t been used. All three conditions must be present in order to trigger recognition:

- The leave is attributable to services already rendered.

- The leave accumulates.

- The leave is more likely than not to be used for time off or otherwise paid in cash or settled through noncash means.

The probability assessment of “more likely than not” is defined in a footnote to Statement 101 as “a likelihood of more than 50 percent.” Determining which leave balances meet this probability threshold requires significant judgment. Paragraph 12 of GASB Statement No. 101 provides organizations with relevant factors to consider related to the assessment of whether the “more likely than not” threshold has been met:

- The government’s employment policies related to compensated absences.

- Whether leave that has been earned is, or will become, eligible for use or payment in the future.

- Historical information about the use, payment, or forfeiture of compensated absences.

- Information known to the government that would indicate that historical information may not be representative of future trends or patterns.

Consideration of these factors along with all other relevant facts and circumstances will be necessary in order to reach an appropriate estimate. The way an organization determines whether something trips this threshold may be different for different types of compensated absences.

Overall, this is a significant change from the extant standard, which used the probability threshold of “probable,” a higher probability than “more likely than not.” By lowering the threshold, all else being equal, it’s likely that more balances will be included in liability calculations than before.

It’s likely that more balances will be included in liability calculations than before.

4. Payrate in the measurement of the liability

It’s important to note that GASB Statement No. 101 requires that the liability be measured using the employee pay rates in effect as of the fiscal year-end. Therefore, changes in pay rates effective after the end of the fiscal year, even if approved prior to fiscal year-end, shouldn’t be reflected in the liability measurement.

5. Identify exceptions and impact

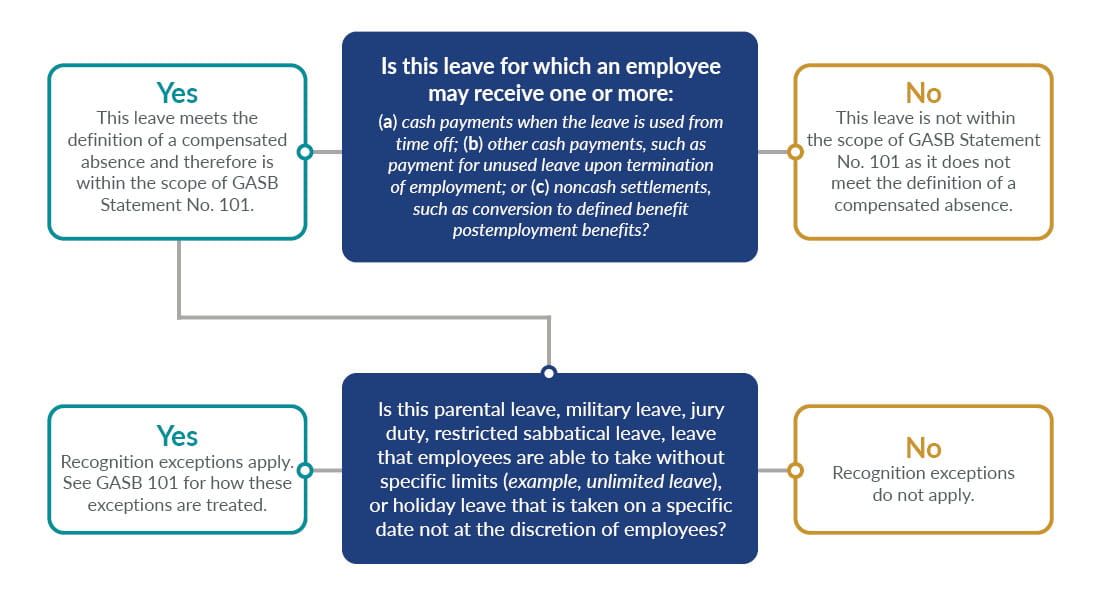

Unlike GASB 16, GASB 101 considers all compensated absences, with limited exceptions for certain types of leave required to be measured when the leave commences or as the leave is used. The following flowchart can be used to assist in scoping out the population of employee leave for which GASB 101 will apply and in identifying certain recognition exceptions within the standard.

Don’t delay

Due to the complexities of this standard, organizations shouldn’t delay in starting the implementation process. These top five considerations will help your organization plan proactively and outline a course of action sooner rather than later.