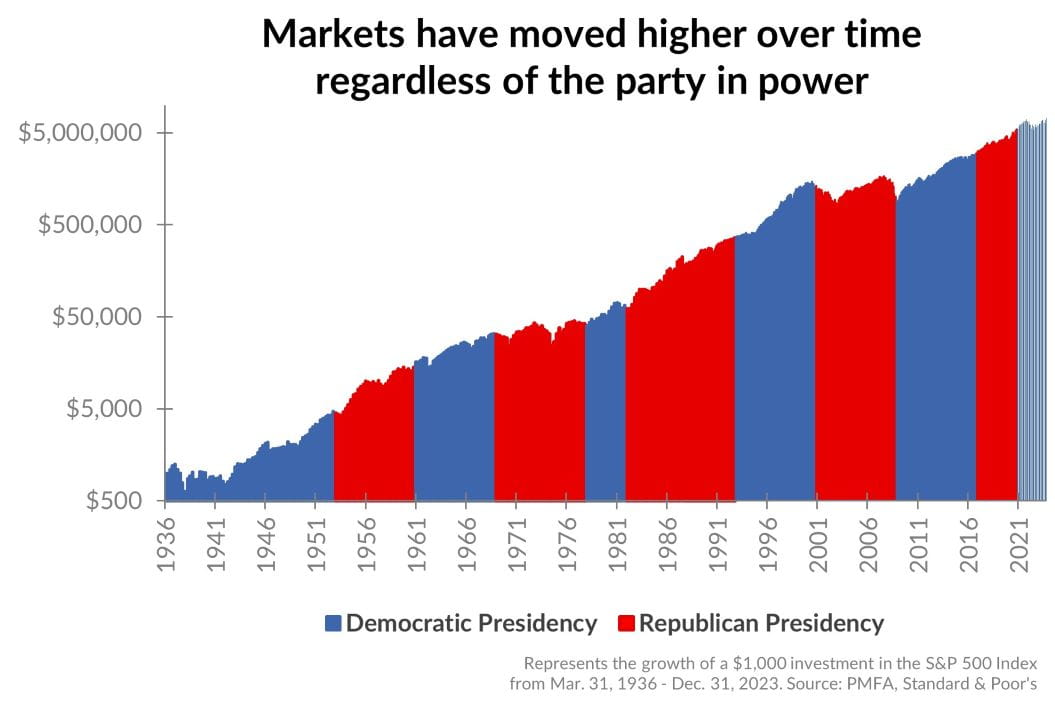

How have changes in leadership in the White House affected the performance of the stock market over time?

As discussed in our accompanying piece, the rapidly approaching November election is leading to more questions from investors about how the outcome could impact their portfolios. Election uncertainty can lead to volatility, yet election years have typically been strong periods for stock market performance and for risk assets broadly. Notably, election outcomes historically have had very little impact on stock returns over the longer term and certainly haven’t derailed the long upward trend in stocks over time.

As shown in the chart above, U.S. equity markets have produced positive returns over nearly every presidential administration, regardless of the party in power. In choosing to stay on the sidelines and out of the stock market during any presidential term, an investor would have missed out on a substantial degree of potential portfolio appreciation. While politics and policy can and do influence the economy and capital markets, other factors have had a larger impact on the performance of the markets over time.

To be clear, we believe that elections matter, as do the policies that are implemented and the legislation that is created over time. As Americans and as voters, we certainly wouldn’t diminish their importance. However, their impact on the stock market and one’s portfolio is often overstated, fueled by either optimism or fear, depending on which side of the election results you happen to be on. The bottom line? Stay invested.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.