Economic momentum in the U.S. faltered in Q1 while inflation gauges surged

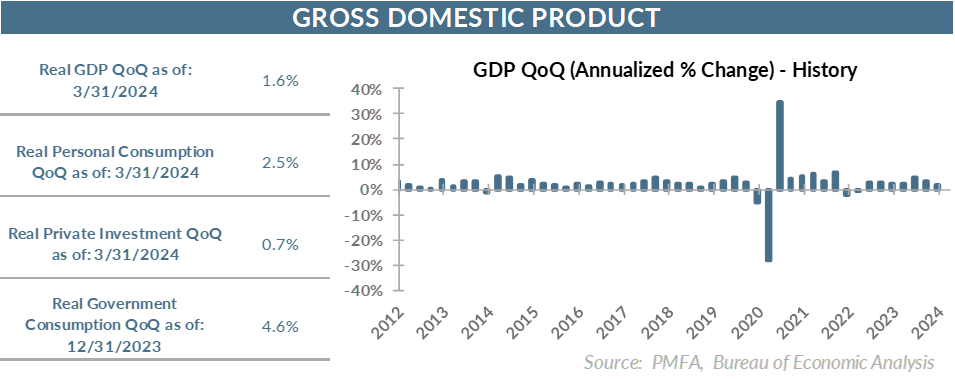

The economy has been slowing since an unexpectedly strong surge that lifted growth near 5% last summer. The fact that slowdown extended into the first quarter wasn’t a surprise; the degree of loss in that momentum was. The commerce department’s preliminary estimate of GDP growth came in at a lackluster 1.6% for the first quarter, notably below forecasts for growth of around 2.5%. The downside surprise clocked growth at its weakest quarterly pace in nearly two years.

If you could look to only one indication of the strength of the economy, you’d start with household spending. Personal consumption expenditures grew at a solid but unspectacular 1.7% pace, but the underlying trend reflects a divergence in spending preferences between goods and services.

Not surprisingly, the loss of momentum in Q1 started with a more constrained spending appetite on the part of consumers. Spending on goods turned fractionally negative, with particular weakness in durable goods. Higher interest rates continue to play a role as the cost of borrowing creates an additional hurdle for consumers to consider before pulling the trigger on financing big-ticket purchases. That’s most apparent in vehicle sales, which were negative for the fourth consecutive quarter.

Despite a decent bounce back as the quarter progressed, a dip in retail sales early this year foreshadowed the potential for a weaker contribution from household consumption.

Conversely, household spending on services held relatively steady, growing by 1.5%. The marked divergence between spending on goods and services reflects the rebalancing of consumer spending preferences that provided a strong tailwind for goods-related retailers amid lockdowns and social distancing in the early stages of the recovery but have increasingly favored the service sector as conditions normalize.

Top-line growth for the quarter was a disappointment but was skewed to the downside by surging imports and a wider trade deficit. That trade gap trimmed 0.9% from top-line growth, while inventories shaved another 0.35%. Weakness outside the United States could remain a headwind to exports for some time, while the strength of U.S. consumers could sustain demand for low-cost goods from abroad.

The continued slowdown in growth is understandable coming off the boil last summer. A reversion to trend growth of 1.5–2.0% is to be expected, particularly given the tighter policy delivered by the Fed aimed squarely at cooling off an overheating economy and reining in inflation.

What’s more concerning is the fact that growth has slowed considerably in the past few quarters while various measures of inflation have remained stuck in a range that remains well above the Fed’s target. That was reinforced in the GDP report as well, with various inflation gauges accelerating during the quarter.

So, is the economy catching a whiff of stagflation? Slower growth with stubbornly high inflation isn’t an outcome that Fed policymakers are aiming for.

Inflation pressures should continue to subside as the delayed effect of greater stability in housing prices and rental rates feeds into the consumer price index in the coming quarters. A reduction in labor demand and lower voluntary turnover should also contribute to a retracement in wage growth toward a level more consistent with a 2% inflation environment. That could still take some time to develop given the elevated level of job openings and strong job creation.

The combination of slower growth and sticky inflation creates one more wrinkle for Fed policymakers to consider as they contemplate rate policy. Still, policymakers appear to be justifiably focused on reining in inflation and not repeating the mistakes of their predecessors by easing too soon, allowing price pressures to reaccelerate.

The bottom line? The economy slowed, but still doesn’t appear to be at risk of stalling. The combination of slower growth and sticky inflation will undoubtedly increase the whispers around potential stagflation risk, potentially complicating the Fed’s job over the duration of the year.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.