March jobs report delivers big upside surprise as job creation easily tops forecasts

Along with inflation, labor market conditions have been front and center for the Fed as policymakers try to deftly rein in inflation without crashing growth. Consequently, monetary policy — and rate expectations in particular — have been the central focus for investors. Today’s jobs report sent a clear message to both: There’s no need to rush to cut rates.

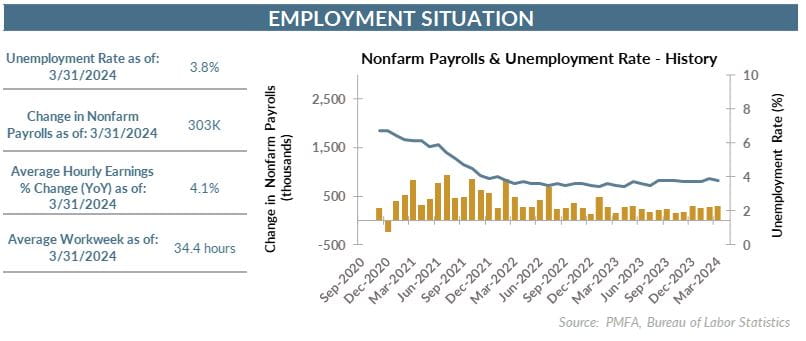

The March jobs report illustrates the exceptional resilience in the labor economy — one in which conditions are tight and job creation remains strong. The labor market has come off the boil of a few years ago but remains on a very solid footing. The unemployment rate edged down to 3.8% in March but remains in the relatively tight range that has been in place since last August.

Job creation accelerated last month, with 303,000 new jobs being added, easily topping forecasts while marking the single-best month for payroll gains in nearly a year. Revisions to the preceding two months tacked an additional 22,000 jobs onto that tally.

The long and variable lags in the effect of monetary policy being absorbed by the economy have seemingly been longer and perhaps more variable than most would have anticipated. Nearly two years after the Fed commenced in its most rapid tightening cycle in decades, the economy continues to advance at a strong clip. The story behind the resilient economy is multifaceted and doesn’t hinge on rates alone. The strength of household balance sheets, the surge in home prices and portfolio values, and strong wage growth have been supportive of continued growth in consumer spending —enough so to offset the sharp increase in borrowing costs for the most part. Contrast that with the housing market, which was pummeled by the one-two punch of surging mortgage rates and soaring home prices.

Whether the strength of the March jobs report is good or bad news is a matter of perspective and goals, but it could represent one half of a goldilocks scenario if inflation can resume its descent toward the Fed’s 2% target. Progress toward that goal has been muted since last fall, with multiple measures of inflation stuck meaningfully above the central bank’s target. It’s good news for the economy and for workers, but for those looking for near-term rate cuts, it’s another blow.

Better productivity gains would be beneficial in tamping down one risk to the disinflationary scenario. Hourly wage growth of 4.1% is a key upside risk to the inflation outlook, particularly in the service sector. Stronger efficiency gains could help to mitigate that risk. A more sustainable pace of increase in shelter costs would also be a positive development — one that appears likely given other data on rental rates and single-family home prices.

There’s still reason for optimism that inflation pressures should continue to recede, but for now the combination of robust labor market conditions and stubbornly elevated inflation puts the Fed in a position in which the incentives to cut in the near term are limited at best.

That likely means higher-for-longer interest rates, and leaves room for longer-term rates to rise further as investors recalibrate their expectations around the timing of Fed easing.

Headlines today tell the story of the labor market, with terms like “blockbuster” and “blowout” leaving little room for nuance. The bottom line? This is a strong labor economy that shows little sign of stalling in the near term. What’s it mean for interest rates? There’s even less reason for the Fed to feel any sense of urgency in announcing that much-anticipated first-rate cut.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.